Money and money supply is an important pillar for the Indian Economy, prospective UPSC candidates need to grasp the significance and practical usage of these fundamental concepts since inquiries regarding this static segment of the UPSC Syllabus can arise in both the UPSC Prelims and Mains exams.

Money serves as a widely acknowledged means of facilitating transactions, being anything that enjoys broad acceptance for the purchase of goods, services, or the resolution of obligations. It holds the distinction of being the most easily tradable asset, akin to gold or silver, owing to its universal acceptance, enabling effortless exchange for other commodities.

Evolution of Money:

Barter System:

The barter system involves individuals directly exchanging goods or services for other goods or services, without the involvement of money as an intermediary. This system is characterized by the exchange of commodities without the use of currency, known as barter exchange.

Positives:

- Basic simplicity

- Absence of foreign exchange complexities

- Prevention of wealth concentration

Negatives:

- Dependency on the double coincidence of wants

- Challenges associated with perishable goods exchange

- Lack of provisions for saving capital

- Absence of a circular flow of income Issues regarding the divisibility or fungibility of goods with similar value.

Commodity Money

Commodity money derives its worth from the underlying commodity from which it is produced. It comprises items that possess inherent value or utility in addition to their capacity to be exchanged for goods. For instance, gold serves not only as a medium of exchange but also finds use in the creation of jewelry. In ancient India, cowrie shells were utilized for transactions.

There are several issues associated with commodity money:

- Inconsistent face value across regions

- Predominantly perishable nature of the commodities used

- Bulky and inconvenient to transport

- Lack of fungibility and divisibility

Metallic Money:

Metallic money consists of coins made from pure and premium metals such as gold and silver. In this form of currency, the face value corresponds directly to the intrinsic value. The value denoted on the coins is termed as the face value, while the value of the metal utilized in coinage is known as the intrinsic value.

Examples of metallic money include:

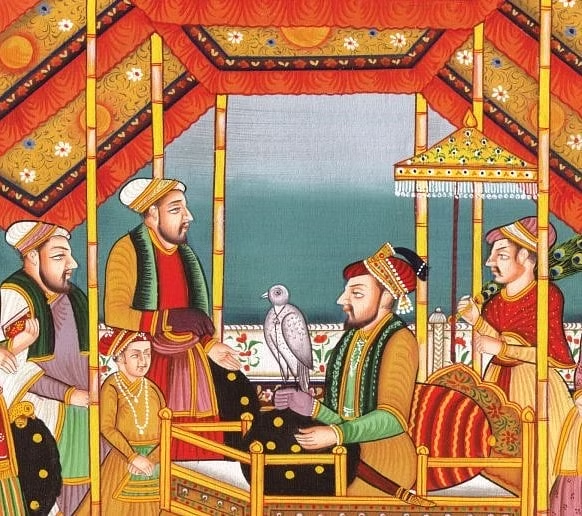

- Gold coins (Muhr) were of high value due to the scarcity of gold compared to silver and copper.

- Silver coins (Rupaiya) held a moderate value.

- Copper or bronze coins (Dam, Paisa) were used for daily transactions.

Fiat Money:

Paper money, also known as fiat money, functions as legal tender due to government backing, ensuring its acceptance for settling debts and transactions within a country’s borders. Central banks regulate the amount of currency in circulation, granting them increased authority over the economy.

When fiat money is supported by a gold or silver standard, it is termed as “representative money.” In such cases, currency acts as an anonymous bearer bond with zero interest, as the central bank commits to pay the bearer a specified sum.

Examples of fiat money include the US dollar, Indian Rupee, and Euro. In India, fiat money is issued by two entities: the Government of India, which issues coins and Rs. 1 notes under the Coinage Act of 1909, and the Reserve Bank of India (RBI), which issues all other banknotes. The RBI central board can recommend the withdrawal of specific notes from circulation, a process known as “demonetization,” which has occurred thrice in India post-independence.

What is Non-Fiat Money:

- Money lacking government legal endorsement

- Plastic coins, cards, and coupons issued by superstores

- Financial instruments like shares, bonds, debentures, government securities (G-Sec), and treasury bills

- Payment instruments such as demand drafts (DD), cheques, credit cards, and ATM cards

- Digital currencies like Bitcoin

Issues with Fiat money:

- Devaluation due to excessive currency printing as a result of monetary policies

- Persistence of bulkiness, limiting portability

- Vulnerability to theft and counterfeiting

- Difficulty in making precise transactions due to challenges in dividing currency into smaller increments, leading to rounding-off issues (e.g., petrol pumps unable to return 60 paise to customers).

Bank Money:

Bank money, supported by the central bank of a country, encompasses instruments such as cheques, bank drafts, NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), credit cards, and debit cards.

The benefits of bank money include:

- Enabling immediate settlement of transactions, saving time.

- Offering the option of deferred payment.

- Facilitating easy transfer over long distances.

- Allowing for the exact transfer of amounts without encountering change-related issues.

- Being difficult to counterfeit or duplicate.

- Can be frozen if the card is stolen, adhering to KYC (Know Your Customer) norms.

Virtual Currency

Virtual currency exists as an unregulated digital currency available solely in electronic form, residing within the blockchain network and not controlled by a centralized banking authority. Users transact and store it exclusively through designated software, mobile or computer applications, or dedicated digital wallets, with transactions occurring over secure internet networks. Virtual currency constitutes a subset of digital currency, which includes cryptocurrencies existing within the blockchain network. It stands apart from digital currency, which is currency issued by a bank in digital form.

Fiduciary Money

Fiduciary money, accepted as a medium of exchange based on trust between the payer and payee, includes examples such as cheques and banknotes.

Credit Money

Credit money, where the monetary value exceeds the commodity value, is denoted by Money value > Commodity value.

Concept of Money Supply (Monetary Aggregates):

The Reserve Bank of India (RBI) established the classification of money supply into four groups: M1, M2, M3, and M4, in addition to M0, in April 1977. Money supply denotes the total stock of money circulating among the public at a specific moment. Terms like ‘money stock,’ ‘stock of money,’ ‘money supply,’ and ‘quantity of money’ represent the total monetary value present in the economy at any given time. Money supply results from the multiplication of the Money Multiplier (m) and the amount of high-powered money or reserve money.

Reserve Money(M0):

Reserve Money, also known as High-Powered Money or Base Money, constitutes the foundation of the economy’s monetary base. It encompasses currency in circulation, bankers’ deposits with the RBI, and ‘Other’ deposits with the RBI, which include deposits of quasi-government entities, other financial institutions, foreign central banks and governments, and accounts of international agencies like the International Monetary Fund.

Narrow Money:

Narrow Money, known as M1 in banking terms, comprises highly liquid assets that banks cannot utilize for lending purposes. It includes currency held by the public, demand deposits with the banking system, and ‘Other’ deposits with the RBI.

M1 = C + DD + OD

- C – Currency held by public

- DD – Net Demand Deposits with banks (Doesn’t include interbank deposits i.e., deposits which a commercial bank holds in other commercial banks)

- OD – These include Deposits with RBI held by certain individuals (former RBI governors can open an account with RBI) & institutions (IMF etc)

M2 (Narrow Money)

- M2 = M1 + Saving account deposits with Post office banks

- M2 is almost equal to M1 as deposits with Post office banks is not much

Broad Money:

Broad Money, referred to as M3, encompasses assets with slightly lower liquidity levels compared to M1. It comprises M1 along with time deposits held with the banking system. The formula for M3 is M1 + TD (time deposits with commercial banks like Fixed deposits, Recurring deposits).

M3 represents the combined value of currency in circulation and total bank deposits, thus reflecting the purchasing power within an economy. Unlike M2 and M4, which also include deposits with Post Office banks, M3 specifically accounts for the ability to make purchases. Post Office banks, unable to provide loans, do not contribute to the purchasing power, making M3 a more accurate indicator in this regard.

High Powered Money:

High Powered Money, constituting the total liability of the central monetary authority (RBI), includes currency in circulation with the public, vault cash of commercial banks, and deposits held by the government and commercial banks with the RBI. It serves as the foundation for other forms of money and is backed by assets such as gold and foreign exchange reserves. In India, high powered money originates from the RBI and the Government of India. The RBI issues various currency denominations and also manages the issuance of one-rupee notes and coins on behalf of the Government, which accounts for a small portion of the total high powered money supply.

Money Multiplier:

The money multiplier represents the maximum amount of broad money that commercial banks can generate from a fixed amount of base money and reserve ratio. It is determined by the ratio of total money supply to the stock of high-powered money in an economy. This ratio always exceeds 1. The Currency Deposit Ratio (CDR) and Reserve Deposit Ratio (RDR) play pivotal roles in shaping the money multiplier. CDR denotes the ratio of currency to total deposits held by commercial banks, while RDR indicates the proportion of total deposits retained by commercial banks. The money multiplier (M) is inversely related to the Reserve Requirement (R), represented as M = 1/R. The monetary base comprises currency in circulation and bank reserves.

Velocity of money:

The velocity of money circulation signifies the frequency with which a unit of money changes hands within a specified period. It reflects the average number of times money transitions between individuals during a given timeframe.

For example, if a person purchases a pen worth Rs. 10 from a shopkeeper who later uses the same Rs. 10 note to buy a Coca-Cola, the same currency note functions as Rs. 20 in total transactions. This phenomenon illustrates the concept of the velocity of money.

Monetary System in India:

India employs the Minimum Reserve System (MRS) instead of the proportional Reserve System. Under this system, the Reserve Bank of India (RBI) must maintain reserves of at least 200 Crore, with a minimum of 115 Crore held in gold. RBI can print unlimited currency against these reserves, which include gold, foreign securities, and Government of India securities.

Established on April 1, 1935, under the RBI Act of 1934, the Reserve Bank of India (RBI) functions as the central bank of India, playing a pivotal role in the nation’s monetary and financial system. The bank’s formation followed the recommendations outlined by the Hilton Young Committee, and it was nationalized on January 1, 1949, solidifying its status as a key institution in India’s financial landscape. At the helm of the RBI is the Governor, responsible for overseeing the bank’s operations and policies. The financial year of the RBI spans from July 1 to June 30, marking its annual cycle of financial planning and reporting.

The functions of RBI include:

- Serving as the sole authority for currency issuance in India.

- Acting as the government’s banker, handling all its financial transactions.

- Functioning as the banker’s bank, with commercial banks required to maintain reserves in RBI, which also lends money to banks.

- Acting as the lender of last resort.

- Providing clearinghouse facilities to banks through mechanisms like NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement System).

- Supervising banks and non-banking financial institutions.

- Serving as the custodian of foreign exchange reserves.

Assets and Liabilities of banks:

Loans and advances constitute assets for banks as they generate interest, while deposits made by customers are liabilities to be repaid. Banks engage in fractional reserve banking, meaning they keep only a fraction of deposits as reserves while lending out the remainder. This practice is regulated by Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), together termed as Legal Reserve Ratio (LRR).

Process of Credit Creation:

Understand process of credit creation with the help of example:

The process of credit creation begins when an individual, say A, deposits Rs. 100 in a bank, which then becomes a liability for the bank.

- As per the legal reserve ratio (LRR), a portion of the deposit is kept as reserve (10% in this example), leaving the remainder available for lending

- The bank then lends the remaining amount (90% in this example) to another individual, B, who receives it in his account with another bank.

- This process continues as the amount is redeposited and loaned out by successive banks, each time maintaining the reserve requirement.

Calculation of Credit Creation:

The extent of credit creation is determined by the Money Multiplier, which is calculated as the inverse of the legal reserve ratio (LRR). In this example, the Money Multiplier is 10.

Credit Creation equals the initial deposit multiplied by the Money Multiplier.

Thus, in this case, an initial deposit of Rs. 100 generates a credit flow of Rs. 1000 in the economy.

Understanding the basics of money and banking illuminates the process of credit creation and its role in enhancing economic transactions and credit flow. With the advent of digitalization, the financial system continues to evolve, giving rise to concepts like digital currency.

Make you UPSC journey easy by finding right mentorship program for yourself. Click here to know more.